(Source: Wall Street Journal)

DALLAS — Since Henry Ford began mass production of the Model T nearly a century ago, car-loving Americans have gulped ever-increasing volumes of gasoline. A growing number of industry players believe that era is over.

Among those who say U.S. consumption of gasoline has peaked are executives at the world’s biggest publicly traded oil company, Exxon Mobil Corp., as well as many private analysts and government energy forecasters.

The reasons include changes in the way Americans live and the transportation they choose, along with a growing emphasis on alternative fuels. The result could be profound transformations not only for the companies that refine gasoline from crude oil but also for state and federal budgets and for consumers. Much of contemporary America, from the design of its cities to its tax code and its foreign policy, is predicated on a growing thirst for gasoline.

As Americans commute less, use more fuel efficient cars and take more public transportation, gas stations have shut down. There are 11% fewer places to pump gas in the U.S. today than there were a little over a decade ago.

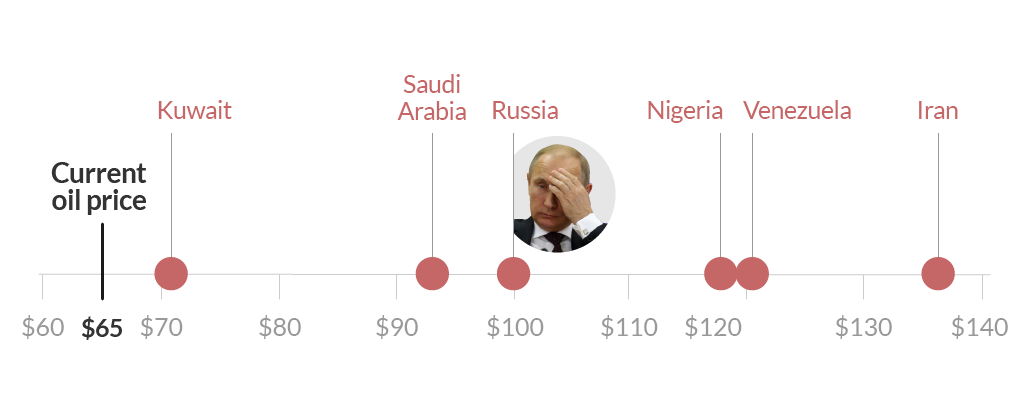

In the vast market for crude oil, American gasoline consumption matters. One of every 10 barrels of crude ends up in U.S. gasoline tanks, more than is used by the entire Chinese economy.

Right now, the recession is curbing U.S. gasoline consumption, as laid-off workers stop commuting and budget-conscious families forgo long road trips. Drivers filled their cars with 371.2 million gallons of petroleum-based gasoline every day in 2007, according to the U.S. Energy Information Administration. It expects that to fall 6.9% to 345.7 million gallons in 2009, as demand at the pump declines and the use of plant-based ethanol increases. Even if usage climbs after the recession ends, it won’t exceed 2007 levels, according to EIA forecasts.

Demand for all petroleum-based transportation fuels — gasoline, diesel and jet fuel — fell 7.1% last year, according to the EIA. This is the steepest one-year decline since at least 1950, as far back as the federal government has reliable data.

Many industry observers have become convinced the drop in consumption won’t reverse even when economic growth resumes. In December, the EIA said gasoline consumption by U.S. drivers had peaked, in part because of growing consumer interest in fuel efficiency.

Exxon believes U.S. fuel demand to keep cars, SUVs and pickups moving will shrink 22% between now and 2030. “We are probably at or very near a peak in terms of light-duty gasoline demand,” says Scott Nauman, Exxon’s head of energy forecasting.

If Exxon is right, the full impact of falling demand for fuel would take years to be felt. But some deep changes are under way.

Click here to read the entire article. Also, don’t forget to explore the interactive graphic that offers some stunning statistics. Below is a video report from WSJ for this story.

The so-called peak oil debate has taken many twists and turns over the years. After long being an oddball survivalist preoccupation, the debate gathered mainstream momentum a few years ago as oil prices began a long ascent from around $30 per barrel to $147, where they topped out last summer. By the time a barrel of West Texas crude was rising eight bucks a day, scarcity seemed like the best and only explanation–that no matter how hard we tried, we couldn’t pump enough oil to meet demand. OPEC cut production, inventories rose, and it seemed like, in fact, we had plenty of oil for the foreseeable future and the whole thing had just been hedge fund shenanigans.

The so-called peak oil debate has taken many twists and turns over the years. After long being an oddball survivalist preoccupation, the debate gathered mainstream momentum a few years ago as oil prices began a long ascent from around $30 per barrel to $147, where they topped out last summer. By the time a barrel of West Texas crude was rising eight bucks a day, scarcity seemed like the best and only explanation–that no matter how hard we tried, we couldn’t pump enough oil to meet demand. OPEC cut production, inventories rose, and it seemed like, in fact, we had plenty of oil for the foreseeable future and the whole thing had just been hedge fund shenanigans.