Guest Post: National Infrastructure Bank – Issues & Recommendations Paper

This guest post by Brendan Halleman, a fellow transportation professional, offers a paper that examines the merits of establishing a National Infrastructure Bank. As you are probably aware, the public discussion around this has been highly politicized and my note merely tries to put quantified elements on the table.

Image Courtesy: Wikipedia

- A National Infrastructure Bank is just one of several possible instruments in the toolbox of policy makers. On its own, it is unlikely to reverse the steep decline in municipal bond emissions which remain the primary capital market for infrastructure funding in the US. Significantly, the Bank’s mandate and project size requirements all but exclude maintenance of existing assets.

- Comparisons with other Government Sponsored Enterprises (such as Fannie Mae and Freddie Mac) appear largely unwarranted on account of multi-layered risk provisions and the Authority’s one-way relation with the capital markets (it can sell to them, but not borrow from them).

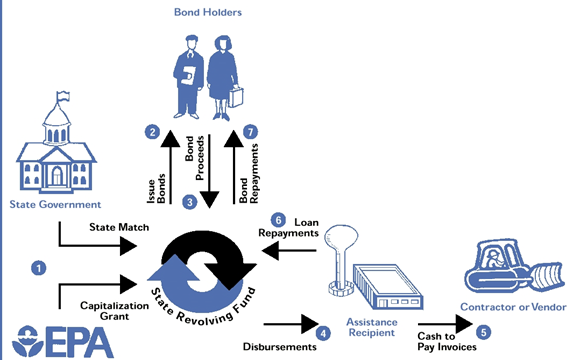

- The Authority complements rather than competes with State Infrastructure Banks for large-scale project funding. SIBs are currently too diverse in size and scope to offer a funding framework commensurate with the country’s infrastructure challenges. Bringing them up to speed across 32 States – and establishing them in 18 others – would take at least as long as creating a new Federal entity. As with the existing SIBs, the Authority’s ability to leverage infrastructure investment would greatly increase were it authorized to recycle project loan repayments (including interest and fees) into new credit.

- An independent Infrastructure Financing Authority is superior in almost every respect to the TIFIA loan program or its Department of Energy counterpart. Through independent project evaluations and innovative financing instruments, AIFA has a far greater ability to tap into a pool of private infrastructure funds worth over USD 200 billion. However, TIFIA’s budget authority can and should be increased for a transitory period while AIFA is ramped up and made fully operational.

- At present, too few surface transportation projects are candidates for AIFA funding as they do not rely on user-based charging mechanisms. This restriction could be lifted altogether, amended to incorporate other PPP arrangements (e.g. shadow tolls) or garnished with a companion Bill to extend tolling options to the interstate highway system.

- EIB offers a convincing compromise between macroeconomic policy objectives and CBA-based project funding decisions. There is nothing intrinsically wrong in tasking AIFA with a mandate to enhance economic competitiveness, mitigate environmental damage and enhance public health. However, individual project decisions must be insulated from political arbitrations and unnecessary Federal requirements, such as “buy America” or wage determination clauses.

- To ensure a shorter phase-in time and a greater degree of private investor interest, AIFA’s official mandate should be extended to include the provision of knowledge dissemination and advisory services to borrowers through a dedicated project preparation facility.

- Although less easily quantified, establishing an Infrastructure Financing Authority will add a new, independent voice on national infrastructure needs and send a strong signal to private sector investors.

Note: Brendan Halleman is a Project Consultant – Communications & Knowledge Management and has extensive experience in the transportation industry. Check out his profile http://www.linkedin.com/in/